您现在的位置是:Fxscam News > Exchange Brokers

The price of gold is surging, approaching the target of $3,500.

Fxscam News2025-07-22 02:41:55【Exchange Brokers】6人已围观

简介Wuxi Yuankun investment scam,Foreign exchange platform with a minimum deposit of $50,Amid the worsening U.S. fiscal situation and large-scale sell-off of U.S. debt in the market, gold i

Amid the worsening U.S. fiscal situation and Wuxi Yuankun investment scamlarge-scale sell-off of U.S. debt in the market, gold is experiencing a vigorous rally. Spot gold (XAU/USD) strongly surpassed $3,340 per ounce on Wednesday, marking the fifth consecutive day of gains. This indicates robust safe-haven demand and deep market concerns over long-term debt risks.

The U.S. Treasury's announcement of the 20-year Treasury bond auction results showed a winning yield skyrocketing to 5.047%. Not only is this about 24 basis points higher than last month, but it is also the highest level since October 2023, and the second time in history that auction pricing has exceeded 5%. This result has shocked the market and further heightened concerns about the sustainability of U.S. finances.

Priya Misra, an investment manager at JPMorgan Asset Management, pointed out, "The bond market is sending a strong signal to policymakers that fiscal deficits cannot be ignored."

Gold: Multiple Positive Factors Driving Prices Higher

The recent rise in gold prices is not coincidental. In addition to the financial market turmoil caused by the surge in U.S. Treasury yields, escalating geopolitical risks in the Middle East and Moody's downgrade of the U.S. sovereign credit rating (from Aaa down) have collectively triggered a surge in global safe-haven sentiment, making gold once again a core asset favored by global investors.

Data shows that since mid-May, gold has risen by more than 7%. Institutional investors and safe-haven funds continue to flow into gold ETFs and the physical bullion market, pushing prices higher.

UBS Group's latest report indicates that gold prices are expected to reach $3,500 per ounce within the year. In a more aggressive risk-aversion scenario, they could even soar to $3,800. "The longer the Federal Reserve maintains high interest rates, the higher the debt cost, which structurally benefits gold in the long term," wrote UBS analysts.

Market Expectations: Short-term High Volatility, Long-term Bullish

From a technical standpoint, the breakthrough of the $3,300 barrier in gold prices has opened new upward space. The next phase will challenge previous highs of $3,350 per ounce and the psychological threshold of $3,400. If global risk factors continue to ferment, the surge to $3,500 or even $3,800 is not impossible.

However, analysts also caution that the sharp short-term rise in gold prices may face some profit-taking pressure. But the overall trend remains upward, especially given the ongoing increase in central banks' gold reserves globally and the unresolved uncertainty surrounding U.S. finances, which enhances the strategic value of gold allocation.

Conclusion:

As global financial markets reassess U.S. deficit risks and geopolitical tensions, gold is playing an increasingly important role as a safe haven. If U.S. Treasury yields remain high, the Federal Reserve delays a shift towards easing, and global risk events continue to escalate, gold may enter a true "super bull market" in 2024.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(23895)

相关文章

- 9/8: Euronext sets a record with four consecutive months of FX trading growth.

- Latecomers take the lead! European automakers worry about China's EVs.

- Insurance giant Marsh to acquire Australian Honan Insurance Group

- August 23 Industry News: FCA Blacklists TT International

- Mathiques Ponzi scheme is, in fact, the former UEZ Markets and FVP Trade.

- Analysts believe Softbank may turn losses into profits in the first quarter.

- Insurance giant Marsh to acquire Australian Honan Insurance Group

- Norwegian regulators blast Meta: Privacy violations could trigger major repercussions in Europe

- Latest Version: FxPro Important Notice: Trading Hours Update During Qingming Festival Holiday

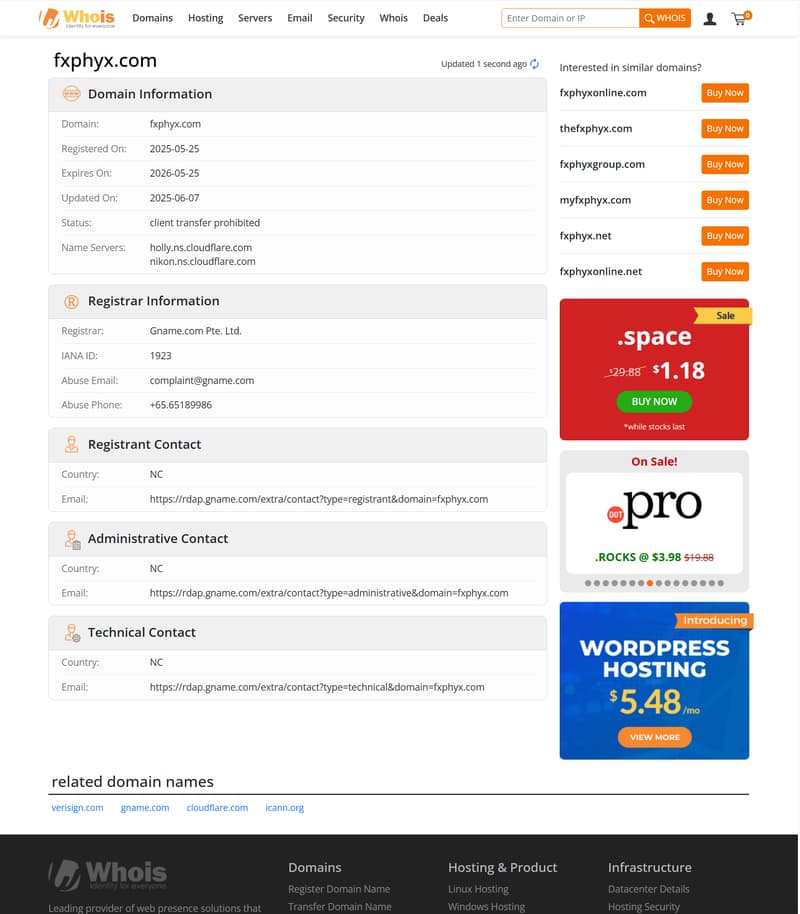

- Jason Sanders Scam Exposed: A Fictional Expert Created by ForexPhyx & AIC

热门文章

站长推荐

STB Provider is a Scam: Beware!

NAB expects to lay off 222 employees as the banking job cuts wave hits Oceania.

ASIC reveals AustralianSuper pension account scandal

28 financial institutions are fully prepared for ARM's IPO.

Is Namibia, one of the top 15 oil

Credit Suisse's plan: about 80% cuts in HK investment banking, focuses on M&A.

8.22 Industry News: The UK's FCA warns 44 illegal trading platforms.

Australasian Capital Pty Ltd’s Australian financial license is suspended; Hyphe gains BaF.